Download Area

Welcome to the Download Area, where you can access all your downloads and updates. We hope you find what you are looking for.

Welcome to the Download Area, where you can access all your downloads and updates. We hope you find what you are looking for.

Navigating from today’s energy market to build future competitiveness

Part 2 – The Future UK Energy Market

Post by Mark Coyle, Chief Strategy Officer @ mark.coyle@utiligroup.com

UK government plan catalyses innovation

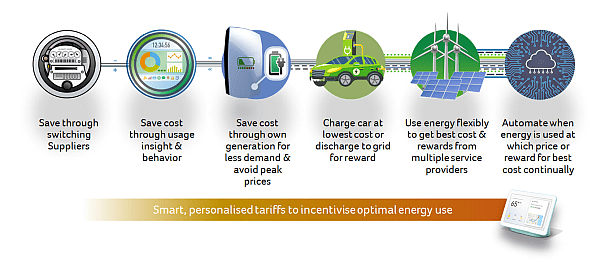

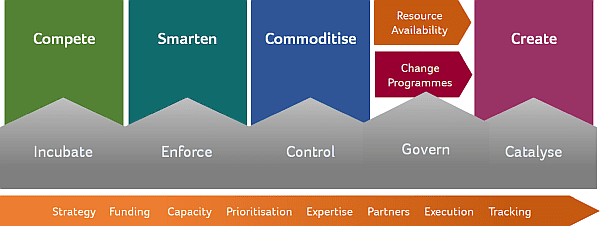

Back in 2017 the UK government set out an ambitious vision of smarter, flexible and distributed energy that benefits customers through data empowered technologies on the basis of consent. This was captured in the ‘Upgrading Our Energy System’ publication by Ofgem in July 2017. Each of us may criticize government for various reasons, but this is one of the world’s first integrated energy strategies that worked back from the possibilities in the future to create conditions for it to be realised. The government has an approach that is integrated broadly across energy competition, networks, technologies, trials and change programmes. This is driving the pace of change to our energy model and avoiding energy competition moving from maturity into an accelerated consolidation.

With such a profound change in the basis of energy, the UK government by seeking to be a catalyst of a proactive early shift for our country is also creating a global test bed, a living lab of approaching sixty-seven million citizens that other countries can learn from, invest in and apply the insight. It is this government vision that once converted into regulatory action, catalyst investment and new change programmes stimulates a competitive shift in our energy market. The shift creates continued internal and global investment into the UK energy market. The investment creates opportunity and enables competitive leaders to scale and innovate further. Energy has transitioned from digital laggard to become a sector where technology innovators seek to bring their value proactive. They can see that the prize in this new competitive race, is a trusting customer who engages with the provider in their energy, mobility and beyond.

So this is an exciting time for energy competition, with the government ambition now converted into change roadmaps and industry system programmes that all Suppliers (and such as Meter Agents) must deliver. The smart metering programme is underway and likely to reach a majority of adoption during the early 2020’s, this is the pivotal foundation of data, engagement and control that unlocks the new co-creation stage of future energy with adopting customers. All of these services, devices and benefits need to be integrated to show the savings, rewards and net cost to a customer in their bill – with the smart meter being the authoritative source of truth (and home connectivity) that enables all this. These are not clip on devices, but measuring devices operating to precise tolerances that can then be trusted for use in wholesale energy trading and flexibility services.

Smart metering as a future foundation

Smart Metering is demanding for all those involved and the UK’s competitive Supplier led roll-out model is only adopted by a few other. Whereas it may seem easier and logical for Distribution companies to deploy the meters in a geographic coverage based way, they do not have any kind of customer relationship today and in a competitive market – they will be flexibility market providers not the new service providers of smart energy savings and control. There are merits for both models, but the government basis is that competitive benefits will be realised at scale by those who engage customers.

As demanding as smart metering is, it is only the start of a major wave of programmes between now and the middle of the next decade. The Faster Switching programme is due to mobilise into its final design and delivery stage imminently which will unlock next day switching for residents and three day switching for businesses. This enables rapid switching into smarter tariffs or even free energy. This will offer further competitive choice and may encourage expanded customer engagement, but it also moves the Supplier relationship from a year as a minimum today down to a month, a week or even a working day.

Customers may become exhausted of engaging manually in this, so it may be delivered automatically over time by auto-switching services or devices and applications used by the customer. In that situation, Suppliers have to be competing proactively in the new market and adapting their tariffs continually or risk always being customer loss. Portfolios may move at scale quickly and change market share in days rather than months; the implications of which are profound.

Towards faster switching and beyond

Faster Switching is targeted for delivery towards the end of 2021 though as with all complex industry change, experience shows that it could take longer. In parallel is the programme for Half Hourly Settlement of electricity, which will then enable tariffs to use smart metering data to settle precisely at a more granular level. Wholesale energy trading can then match this which is difficult today with small volumes that may not match Supplier metered values accurately leading to imbalance settlement positions. Suppliers will be regulated to deliver this programme if approved, but changes in energy trading businesses are highly complex and have wider dependencies than just central market systems.

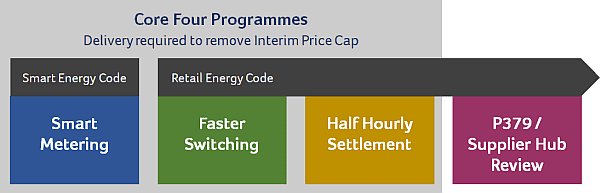

Delivering the Smart Metering Implementation Programme (SMIP), Faster Switching and Half Hourly Settlement are the pre-requisites for lifting the interim Price Cap by Ofgem. The delivery of these interdependent programmes is complex and may struggle to complete during 2021, meaning that the Cap could yet extend onwards placing continued pressure on Suppliers who are impacted.

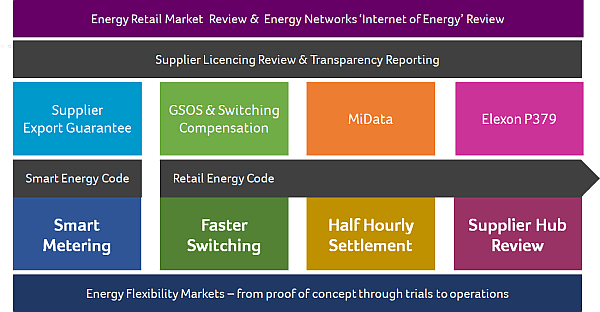

These three major programmes are not the full extent of changes though, with others such as Midata to create a customer consent framework for the use of data, Supplier Export Guarantee to replace Feed In Tariffs for net customer export, implementation of Switching compensation and review of Supplier licensing and operational reporting. In addition, trials and scoping is underway on the changes to energy networks and flexibility of customer energy on the grid in parallel. InnovateUK is investing in trials in areas such as, customer engagement in smart energy and EV control (which we have been involved extensively in during the early part of this year).

On the horizon is perhaps the biggest change of them all for competitive energy Suppliers and technology innovators, this being the review of Supply itself and specifically the ‘Supplier Hub Review’. This has the most far reaching implications for the Supply model, opening the concept of multiple Suppliers per meter with associated impacts on business model viability, customer engagement and movements in customer spend. This also explains why energy Suppliers and new technology innovators have a creative tension in their dialogues (unless they are one and the same organisation). The tension is because, they will end up competing for customer access, wallet share and solution adoption.

There will be multiple types of relationship for customers but they are mutually incompatible. So long as there is a competitive market, organisations struggle to collaborate and instead end up building their own private competitive platform that interoperates through mandatory market standards and central systems. The requirement for and growth of standards and common data exchange between platforms is pivotal to competitive interoperability and an area of our key market engagement to ensure open markets are accessible to all.

Four core programmes to transform competitive energy

Moving through maturing competition and commoditized energy engagement towards co-creating the future basis of energy has four core programmes of energy transition, which are the mandatory delivery basis for Suppliers. Smart Metering, Faster Switching, Half Hourly Settlement and Supplier Hub Review are the new ‘Core Four’ dependencies for energy Suppliers. Their ability to deliver them is genuinely existential to their future ability to compete. These programmes are dependent on changes to industry systems delivered through the software used by Suppliers of today and in future.

We focus on providing these non-customer core systems and their services at the highest scale, with industry change engagement at more than forty groups, smart metering as the foundation being delivered for over eighty companies, learning through data insight and then turning this into the platform capabilities within our customer eco-system. They will always own the customer facing value but can build upon our platform, scale, change abilities and cross-sector, multi-country engagement.

Navigating to the next competitive market

Our relationship with Energy Suppliers and technology innovators takes us back to the second key demand that companies need to transition over to the next basis of energy. If the first discussed is the ability to deliver all these mandatory industry changes (and create competitive opportunity from them), the second is the resources available to them.

Competitive energy leaders are lean, with simple business models focused on the customer. They work with a core set of service delivery partners who combine quality, performance, compliance, change and innovation as the qualities they provide. This is a time of great opportunity and risk, creating the systems review and migrations as companies professionalise and orientate for future energy competition. There are often limited resources available in competitive energy companies in terms of investment capital, skills available, executive access and technology expertise to highlight a few areas.

These are businesses who already have a demand business environment in which they are growing, with customer assumptions of engagement evolving continually from offline to online and from there to social media wherever and whenever they access it. Not all companies can make this transition effectively, those that do will be the new competitive leaders for future energy. Creating an integrated strategy, platform roadmap, resource utilization and engagement approach that underpins the shift from today’s market to the next in the best way. We welcome building this together so that our directions align with each other, with the future market and most importantly, with the interests of customers at all times.

Ensuring no customers are left behind

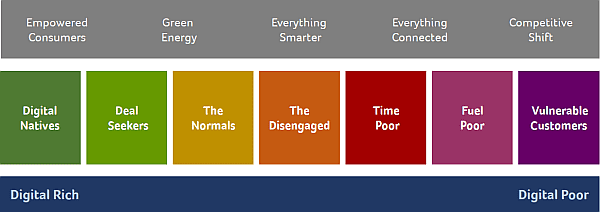

As technology transforms energy as it is other sectors of our society, it is vital that nobody is left behind. Those who are vulnerable, disengaged, scared or unable to engage need to be supported and ways found to benefit them in their energy use. Otherwise we will have growth of a new ‘technology fuel poor’ who cannot control, produce or optimise their energy. Ofgem is leading a review of customer vulnerability during summer of 2019 which is a valuable and timely initiative, to consider how to reach all customers whilst allowing the specialization and personalization that technology enables.

Vulnerability of customers becomes acutely important as the reach of technology extends. We need to ensure everyone can benefit from competitive markets and reach customers not engaging online or do not trust the providers today who may be further put off by auto-switching. With care and the right assurance controls, engaging customers directly in person has started to re-emerge as an alternative approach to those engaging online. Competitive specialism and customer niches extend the reach of markets though regulators seek to ensure customers are not required to pay an unreasonable premium for this basis of engagement.

The pace of technology to engage often outstrips our abilities as a society to ensure they reach everyone and with the right protections. As the opportunity to engage grows, customers should not be confused, scared or have to be concerned about security and privacy. As a sector it is all of our duty to get that right and embed it into our culture at all levels.

Our commitment to empower future competitiveness

We are engaging both with industry committees, catalyst bodies, technology innovators and investors in combination with forming shared future strategies with our customers. We have dedicated resources and time to engage in the market, apply the insight and drive industry change. As part of this we created our increasingly popular ‘Smarter Energy Insights Forum’ with government, regulatory, industry bodies and stakeholder organisations sharing with our customer and affiliate community in an intimate, applied way. Our forum runs a number of times a year and we welcome contact about attending.

Energy competition is at the crossroads. It is time to engage, plan and mobilise to co-create future energy with customers and avoid being commoditized. Working together we will help to co-create the next basis of energy and continued competitive energy leadership. There is much to do, but this work introduces both risks and huge opportunity. Our market will build upon switching trends, creating trust and consent for Suppliers with the right culture who can then build shared benefits with their customers. The complexity of technology can be removed and the experience of energy transformed to deliver reward and benefit instead of the old unpopular bill.

We welcome contact and discussion to help co-create your competitive energy leadership. Whether you are in the market today, a Supplier or technology innovator, a prospective entrant – the opportunity is there for all.

Energy empowers the digital society. It is the new lifeblood of our economy

From being the digital laggard, the energy sector is now the technology frontier. It’s never been more exciting to be part of this sector, but our hard work together will only grow from here. At Utiligroup, we will enable you to make energy smarter for everyone.

Please do contact us about your UK energy competition business strategy, industry changes and mobilizing together for your future competitive leadership.

Customers and affiliates who wish to participate in our Smarter Energy Insights Forum, please contact the author.

To read part one of this article, considering the fast changing UK energy market today and the emerging of retail commoditisation click here

Mark engages extensively with competitive energy leaders globally to drive new insight and apply this to the platform enablement by Utiligroup and the wider ESG. Through 2018 he has been engaging with a range of innovators in UK and globally to explore how energy competition moves to the next era at scale. UUtiligroup is working with its growing customer base and eco-system partners to create new competitive innovation at scale in the digital era.

Contact Mark or join us at any of the events mentioned below by email at mark.coyle@utiligroup.com.

Further reading & contact

Read our other https://esgglobal.com/smarter-energy-insights/

and connect with Mark at https://www.linkedin.com/in/markcoyle/

Mark’s energy market insight feed is at https://www.twitter.com/markcoyleuk

Email today to explore the next wave of energy supply via mark.coyle@utiligroup.com

| Release version | Release Date | Version details |

|---|